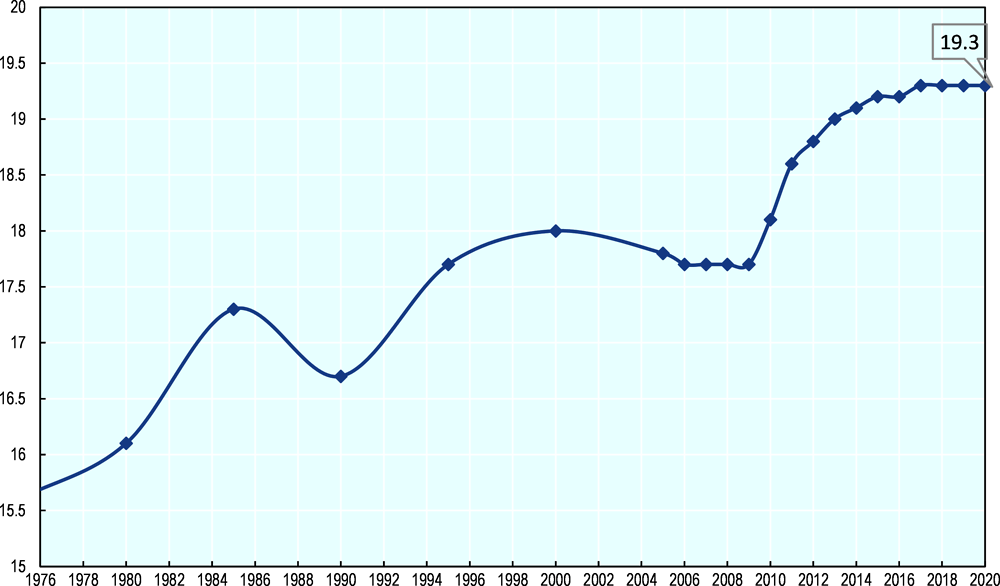

2. Value-added taxes - Main features and implementation issues | Consumption Tax Trends 2020 : VAT/GST and Excise Rates, Trends and Policy Issues | OECD iLibrary

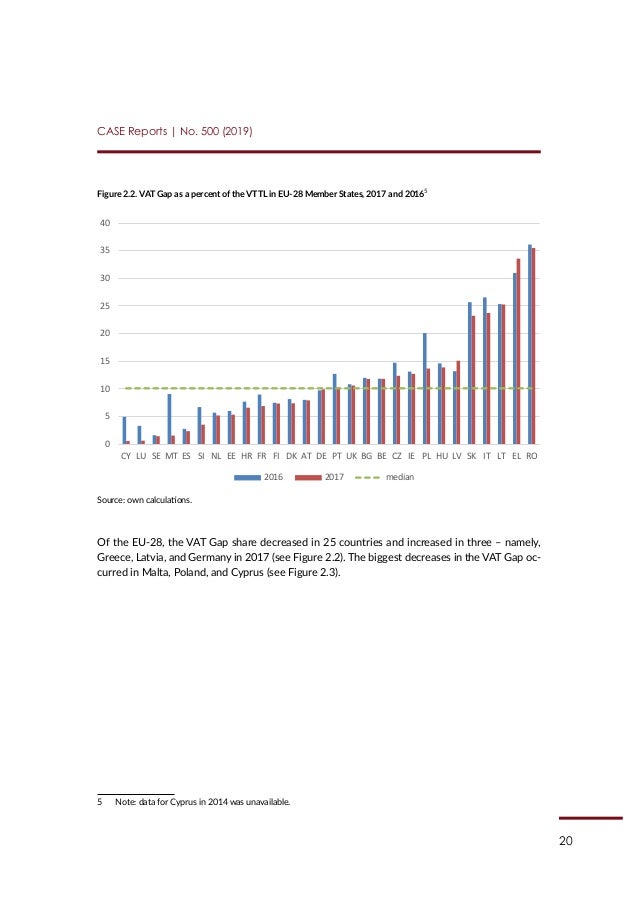

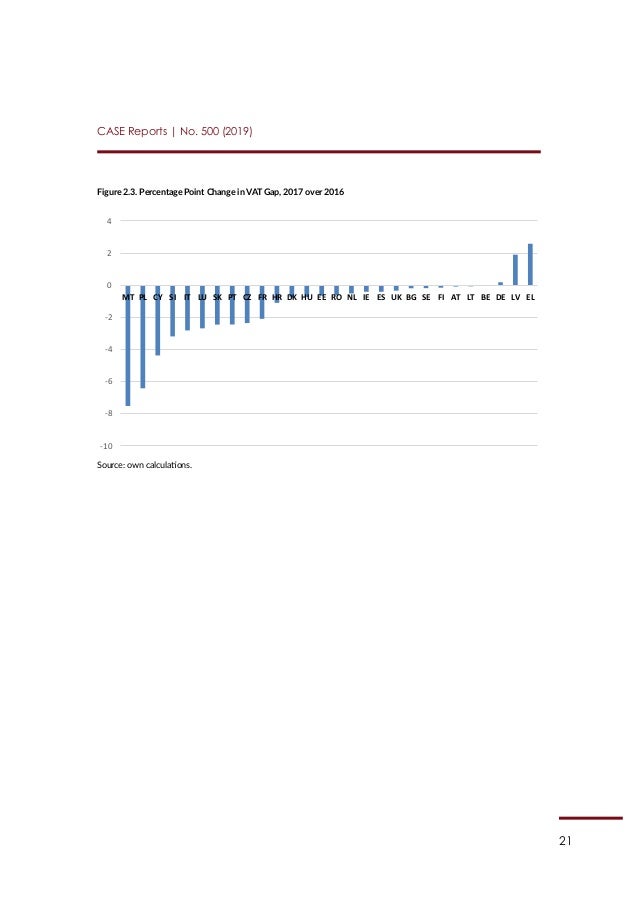

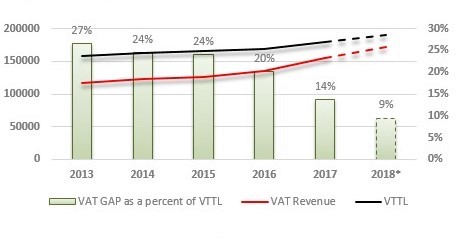

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research

EU Tax & Customs 🇪🇺 on Twitter: "What is #VAT gap? FAQ on 2016 VAT Gap Study > https://t.co/a6dkL6jmm6… "

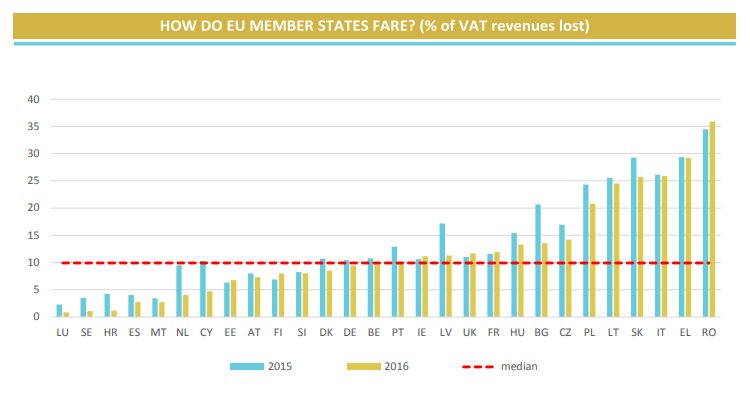

EU Tax & Customs 🇪🇺 na Twitteru: "The VAT Gap decreased in 25 Member States and increased in three. Individual performances across Member States still vary significantly. #VATGap… https://t.co/JmDcyjett8"

EU Tax & Customs 🇪🇺 on Twitter: "EU Member States still losing almost €150 billion in revenues according to new figures. More about the VAT Gap report: https://t.co/LLdVPzqUTB #VAT… https://t.co/LUd6N7oDAE"

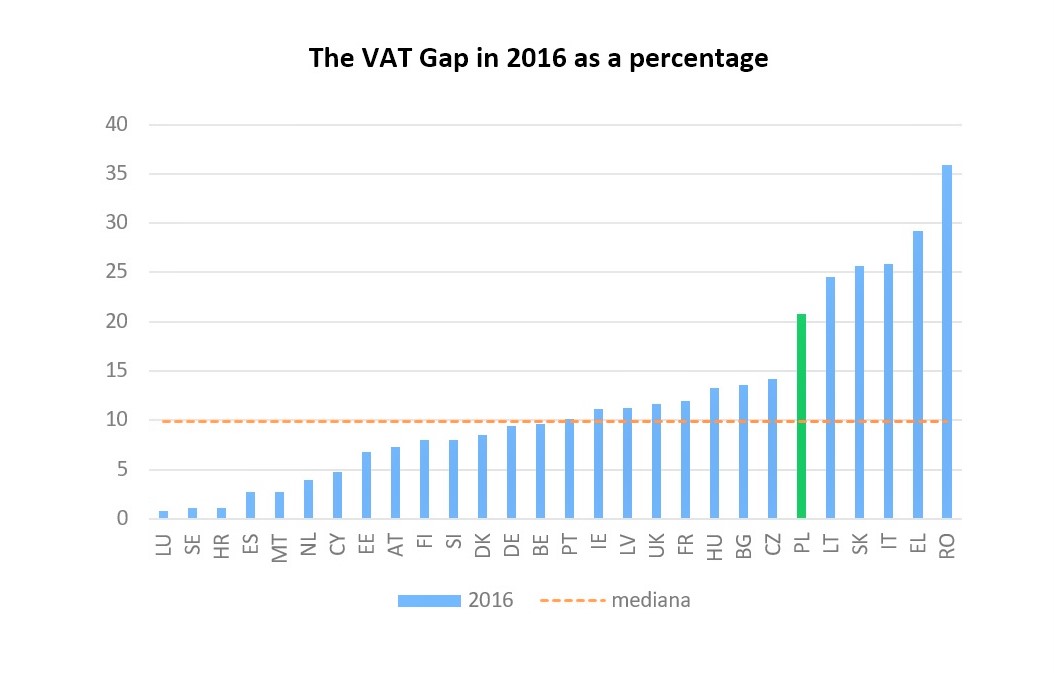

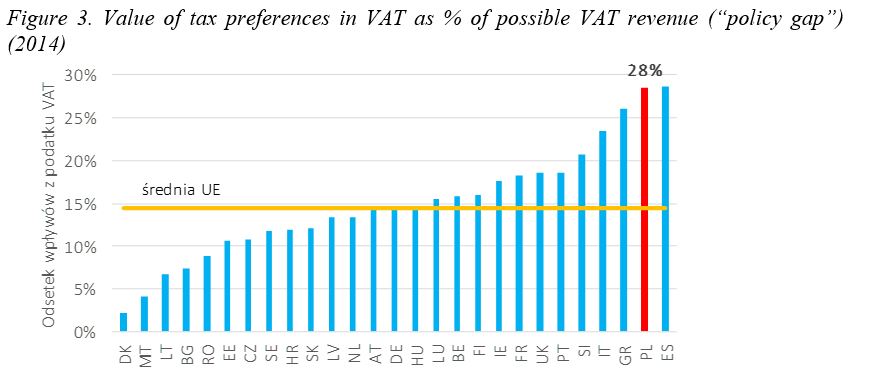

VAT gap in the EU-27 in 2014 (% VTTL). Source: TAXUD/2015/CC/131, 2016,... | Download Scientific Diagram